Dental Insurance

Delta Dental of Washington

Choose from eight plans with five annual maximum options. All plans include surgical and non-surgical TMJ benefits.

More Information

-

Extensive Network

- Premier – 90% of dentists in Washington state

- PPO – 60% of dentists in Washington state

- Participating – dentists in all 50 states

-

Incentive plan, voluntary plan and two orthodontia riders available

-

All plans include surgical and non-surgical TMJ benefits

-

All Class 1 diagnostic and preventive services covered in full and without reducing the annual benefit maximum

-

Child and adult orthodontia benefit options for groups of 10 or more enrolled employees

-

Lower premiums for groups of 10 or more enrolled employees

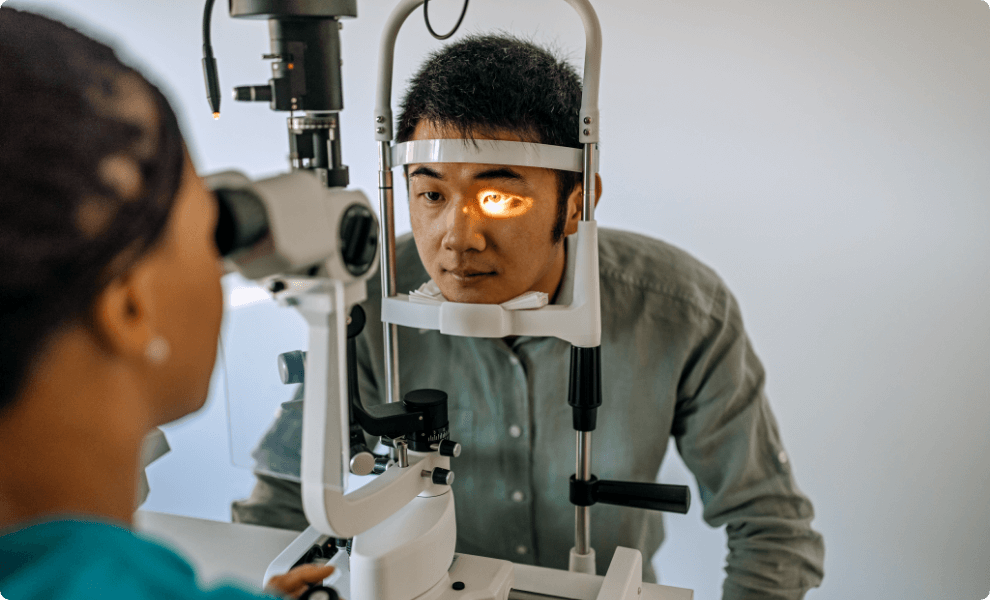

Vision Insurance

VSP Vision Care Inc.

Choose from seven plan variations that all include annual wellness exam, Computer VisionCare Plan, full coverage for UV coating and scratch coating, Suncare frame benefit for non-prescription sunglasses, and more.

More Information

-

Value and Savings. You’ll enjoy more value and low out-of-pocket costs.

-

High Quality Vision Care. You’ll get great care from a VSP network doctor.

-

Choice of Providers. With the largest national network of private-practice doctors it’s easy to find the in-network doctor who’s right for you.

-

Great Eyewear. It’s easy to find the perfect frame at a price that fits your budget.

-

Wellness Discounts. Value adds including polycarbonate lenses for dependent children; TruHearing discounts on laser vision correction and prescription sunglasses; Eyeconic included with all plan options.

-

Computer VisionCare (CVC) can be added to Plan B and Plan C.

Life Insurance / Long Term Disability, AD&D

USAble

Life doesn’t always go as planned. Help your employees feel prepared with a Basic or Voluntary Life insurance and Long-Term disability plan.

More Information

-

A variety of options. Basic Life and AD&D insurance plans from $15,000 to $200,000 and also Voluntary Group Term Life buy up options (Up to $300,000 in coverage with $100,000 guaranteed issue) for employees.

-

Three Long Term Disability plans. Available to employers with five or more employees.

-

All plans include travel and medical support services.

Accident Protection

AIG

24-hour accident protection worldwide, with optional family coverage.

More Information

-

Pre-travel assistance. Advice on immunizations, arranging medical care, and travel precautions.

-

Medical emergency services. World-wide 24-hour medical location services, transport arrangements, case monitoring.

-

Legal assistance. Legal referrals. World-wide, 24-hour legal services for non-criminal emergencies.

Pet Insurance

PetPartners

Pet insurance is health insurance for dogs and cats. Get reimbursed for costly veterinary bills. Plans feature comprehensive coverage for accidents, illnesses and injuries including cancer coverage.

More Information

-

Choice of accident & illness or accident-only plans

-

Choose your deductible amount

-

Choose your co-insurance amount

-

Customize your plan by adding coverage for wellness, exam & office visits, inherited & congenital diseases, and end of life care

-

Discounts on retail pet purchases: 10% for one pet, and 15% for two pets

Employee Assistance Program

TELUS Health (formerly BHS)

Our partner TELUS Health provides BHT members and their employees with a robust Employee Assistance Program (EAP).

This benefit is offered at no additional cost on Industry Health Trust plans. Kaiser Permanente Small Group plans or non-medical offerings can add the EAP for an additional cost.

More Information

-

6 visits annually

-

There are never any claims to file, and EAP visits are covered at 100%.

-

Your use of the EAP is completely confidential.

-

In addition to referral for assessment, counseling, or medication management, your Care Coordinator can assist you in determining the appropriateness and availability of community resources (such as support groups) that might be beneficial).

-

Telehealth options available. Members can speak with a provider via computer, smartphones, and tablets at their convenience.

Identity Theft Protection

Norton LifeLock

Comprehensive protection features from Norton LifeLock to help your employees feel safer in their digital life.

This benefit is offered at no additional cost with our Industry Health Trust plans. Kaiser Permanente Small‐Group plans or non‐medical offerings can add this benefit for a small fee.

More Information

-

Device Security protects your mobile devices, tablets, and computers from hackers, viruses, malware, vulnerable websites, and other online threats.

-

Identity Alerts with Credit monitoring alerts you if there is fraudulent or suspicious activity surrounding any of your personal information,including new account opening, credit card usage, and data breaches.

-

Social Media Monitoring notifies you of any suspicious links, account takeover attempts, or inappropriate content.

-

Norton™ Secure VPN Virtual Private Network (VPN) helps protect your online privacy so your sensitive information, browsing history, online activities and webcam are more secure.

-

Parental Control makes it easy to monitor your child’s online activities and view their search history so they stay safe.

-

Million Dollar Protection™ Package to reimburse stolen funds, personal expenses, and provide coverage for lawyers and experts up to $1 million each.